Growth Strategy

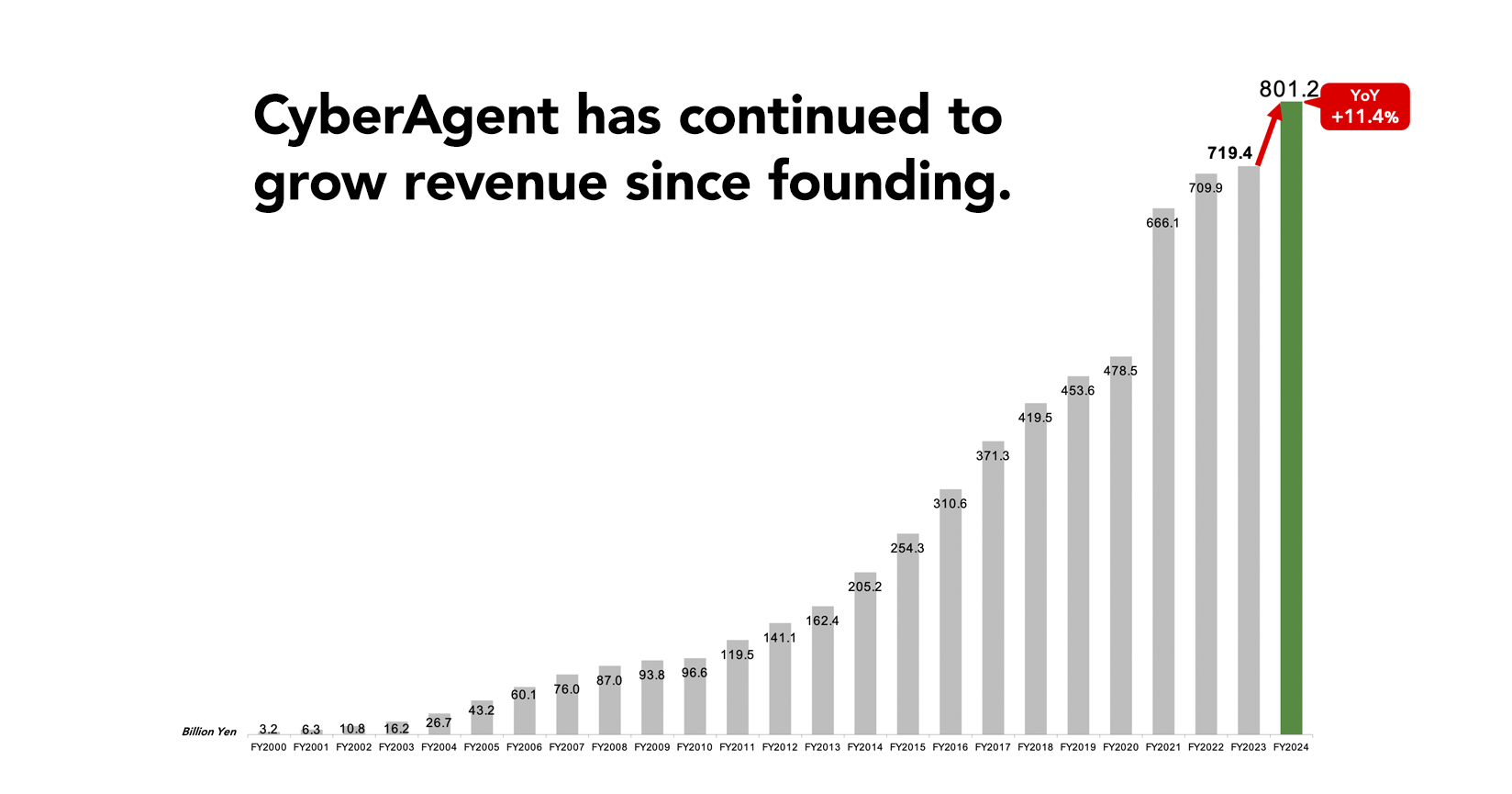

With the vision of "to create the 21st century's leading company", we have continued to increase our revenue since our establishment by leveraging our adaptability to change rooted in creativity, technological capabilities, and human resources.

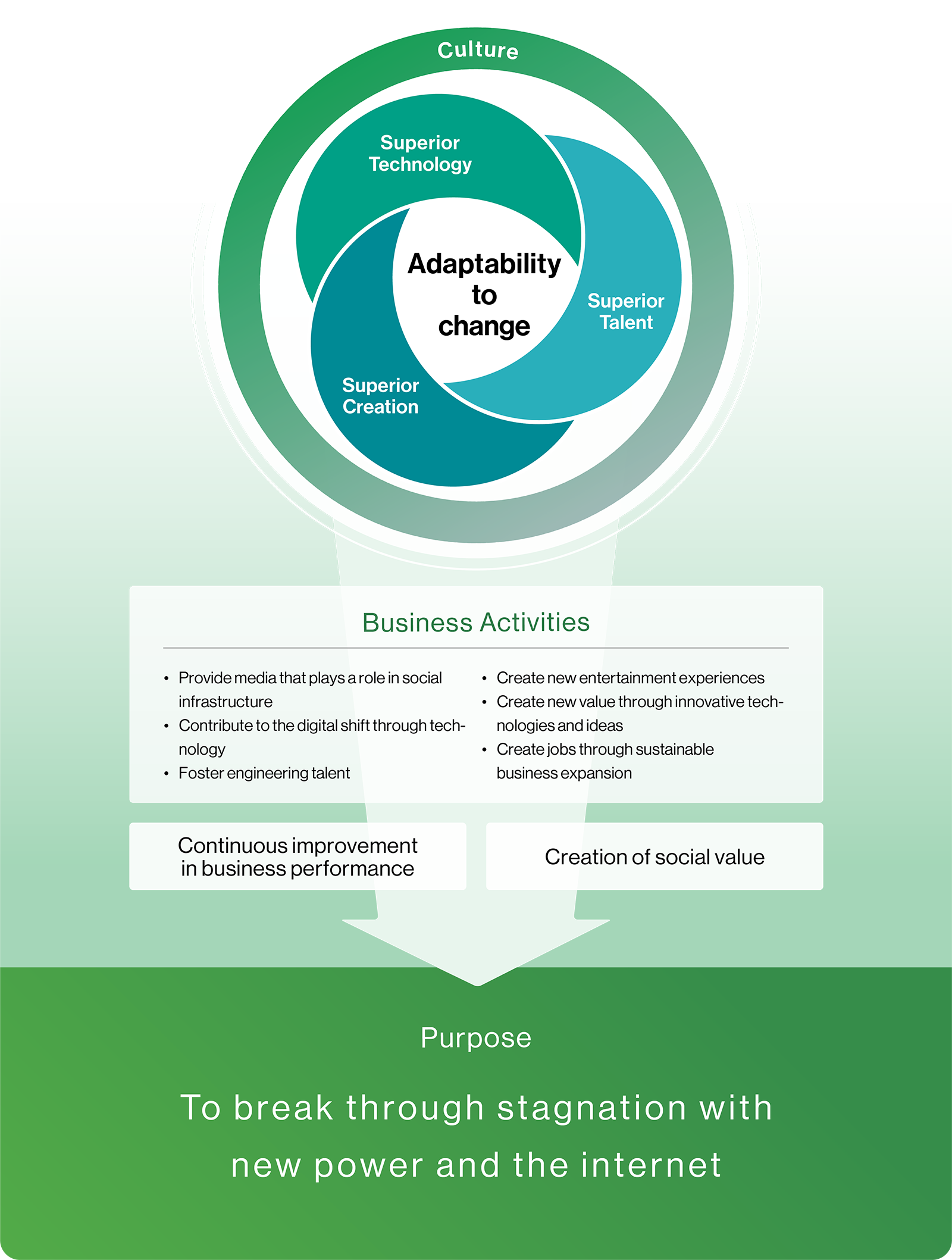

Value Creation Model

Consolidated Sales History (listing – present)

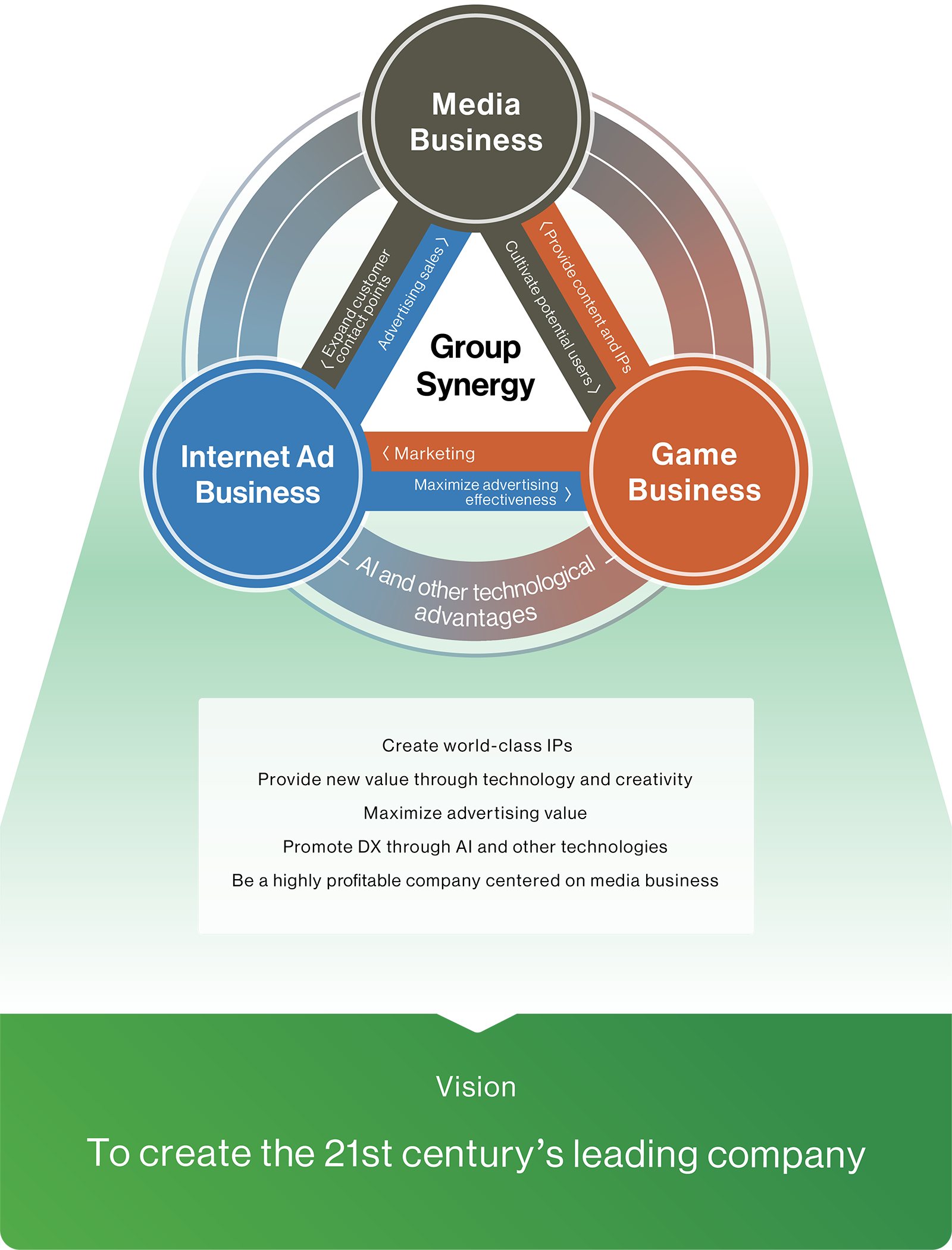

CyberAgent operates its businesses in the growing internet industry, focusing on three key areas: media & IP, advertising, and games. While investing upfront in creating various new businesses and improving its technological capabilities, we aim to develop ABEMA, the new TV of the future, into a medium with social impact and strengthen group synergy.

Business Model

We believe that the growth of our personnel leads to sustainable business expansion. To achieve it, we are committed to recruiting, training, and energizing people and placing the right person in the right position. Through the discovery, entry, and commercialization of growing markets, many talents are gaining management experience while tackling a variety of businesses.

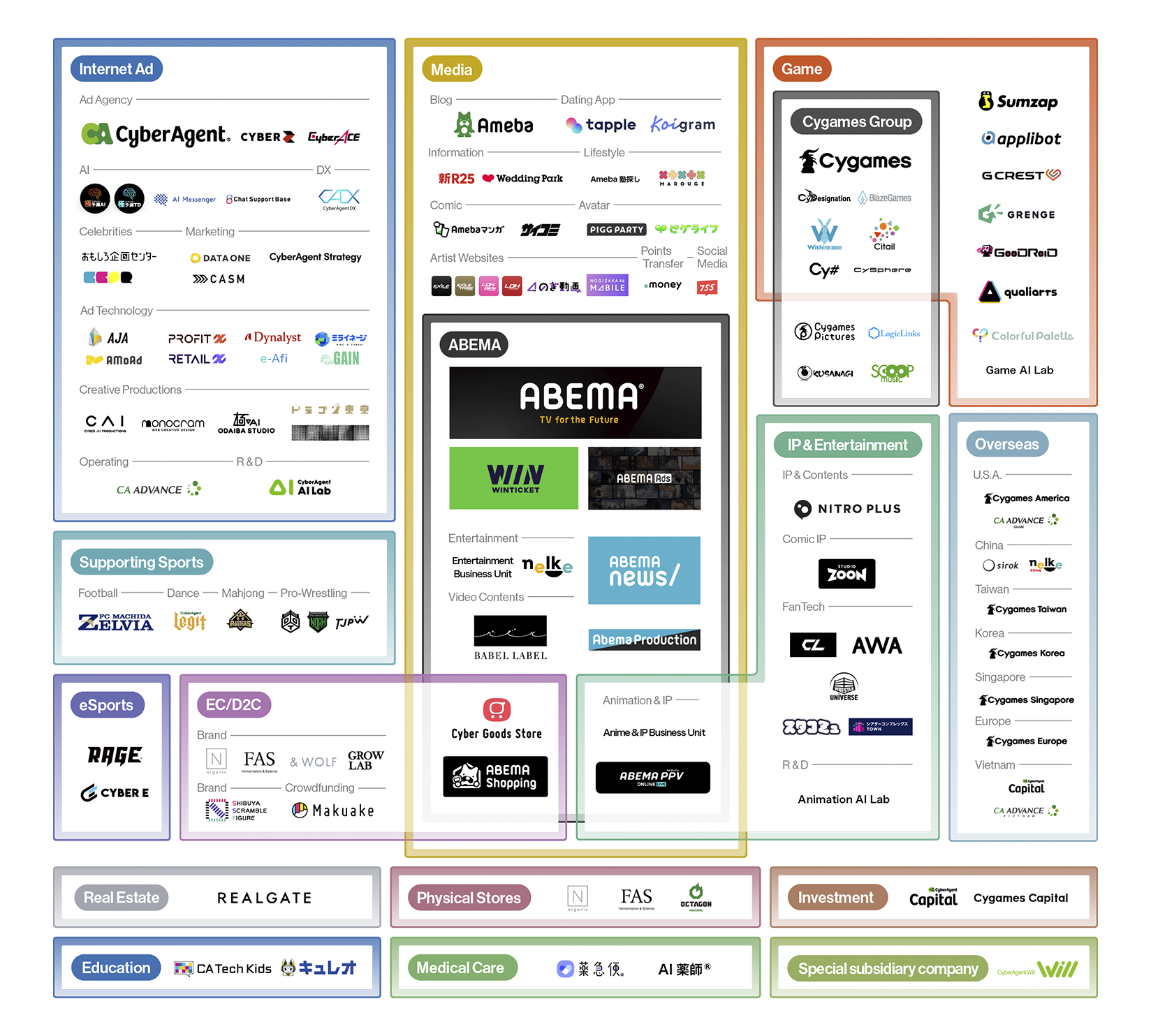

Various businesses support sustainable growth

- * Our Major Products and Services at a Glance (As of September 30, 2024)

In its capital policy, we focus on securing funds for growth that will contribute to expanding CyberAgent's business, maintaining a stable financial position, and increasing management efficiency. Also, we consider the return of earnings to shareholders a top management priority. In addition to increasing the stock's value over the medium to long-term through business growth and improvements in capital efficiency, we intend to continue to pay dividends.

We will continue to grow by leveraging our adaptability to change, such as technological innovation and environmental change under our purpose established in October 2021, 'To break through stagnation with new power and the internet'.