Dividend

We aim to mid to long term increase the stock price and pay dividends consistently.

Dividend Policy

CyberAgent considers the return of earnings to shareholders to be a top management priority. In addition to increasing the stock's value over the medium to long-term through business growth and improvements in capital efficiency, we intend to pay dividends continuously. Therefore, we set DOE of 5% or more as a management guidance in fiscal 2017.

Year-end Dividend

According to the DOE 5% management guidance, the year-end dividend for FY 2025, ended September 2025, is 17 yen. The FY 2026 dividend forecast is set at 19 yen.

| Fiscal Year | Dividend per Share |

|---|---|

| FY2026 | 19 yen |

| FY2025 | 17 yen |

| FY2024 | 16 yen |

Dividend History and Forecast

Share Buyback and Cancellation

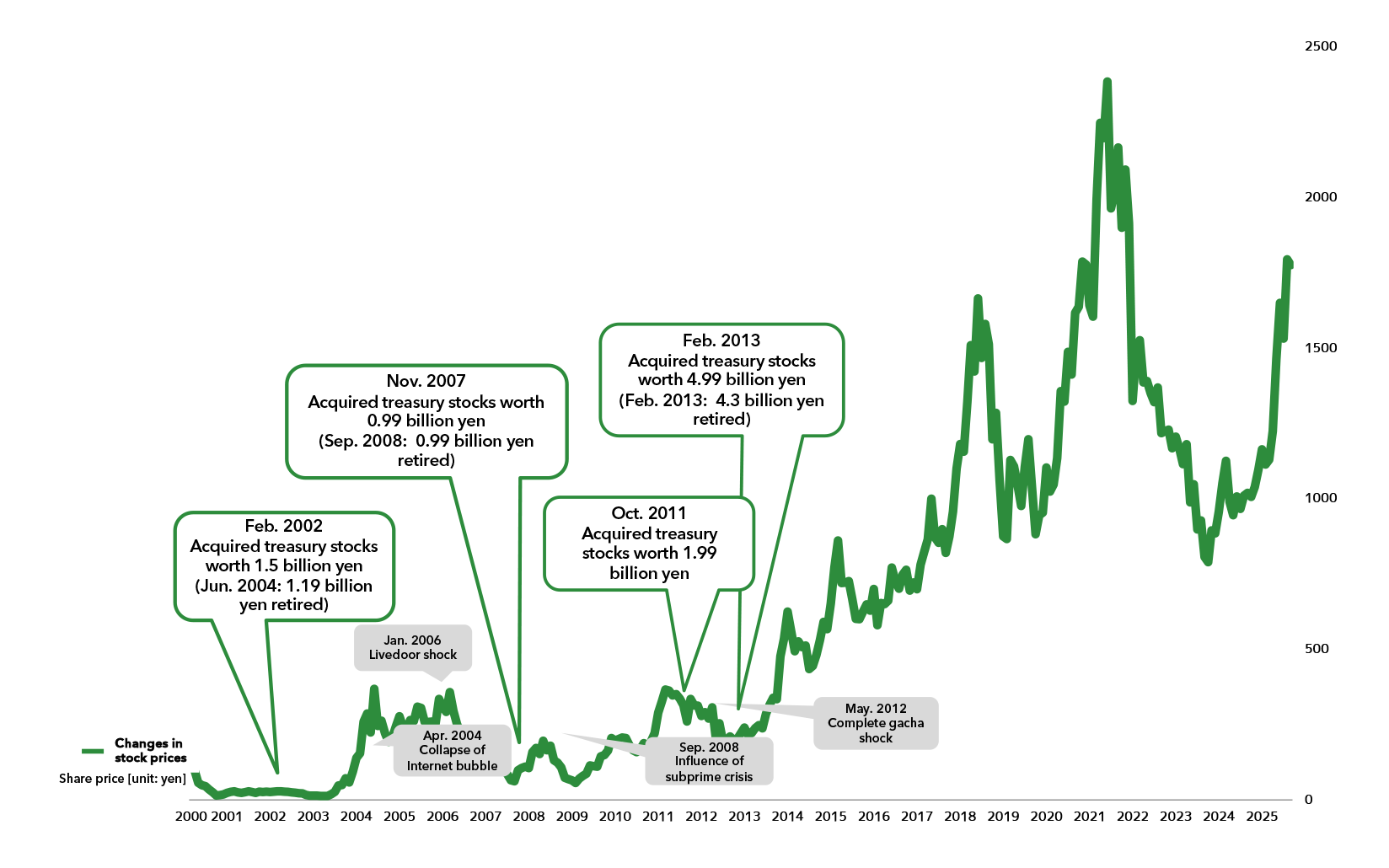

We had implemented four share buybacks and cancellations in the past.

| Transaction Period | Purchase Method | Amount |

|---|---|---|

| to | Purchase in the open market | 4.99 billion yen |

| to | Purchase in the open market | 1.99 billion yen |

| to | Purchase in the open market | 0.99 billion yen |

| to | Purchase in the open market | 1.5 billion yen |